Simply 1, all of us comprehensive the very first 5 methods how in order to reduce your vehicle insurance charges. Simply two, all of us demonstrate the 2nd 5.

ACTION 6 — Evaluation, Alter or even Cancel Absolutely no Problem & PIP (Personal Damage Protection)

No-Fault Protection, and it is Double — PIP — began because excellent idea’s. Your own rates had been really likely to end up being decreased. After that, a state Political figures obtained included (at the actual advocating associated with Insurance coverage Lobbyists, associated with course) as well as mucked this upward.

The thing is, no-fault insurance policy had been initially meant to possess every person’s deficits, included in their very own auto insurance organization — regardless of who had been to blame.

These days, in several Says, auto insurance businesses tend to be producing a lot of cash upon no-fault since the insurance providers persuaded Condition law-makers to create “modifications. inch

These days, due to the these types of modifications, auto insurance businesses possess really utilized the actual no-fault laws and regulations to lessen obligations on the declare produced by a person, rather than decreasing auto insurance rates since it had been designed to perform.

Therefore, rates carry on up-and-up as well as insurance providers wind up having to pay much less with regard to statements — Somebody’s obtaining wealthy upon which offer…. and it is not really a person.

And also to help to make issues even worse, a few Says (with truly, truly gifted Insurance coverage Lobbyist’s) additionally need one more high quality end up being compensated along with the actual no-fault high quality. This particular elegance is known as Injury Safety (PIP).

PIP is really a “wide-blanket” associated with protection and may supply Crash Protection, Hospitalization, Interpersonal Protection Impairment, Workmans compensation, Individual Impairment Insurance coverage & Life insurance coverage.

The issue along with PIP as well as exactly what this handles is actually….

A person currently offered the majority of, otherwise just about all, of those coverage’s anyhow, not? Therefore, you are having to pay two times!

ACTION 10 — End Thorough & Crash Protection Upon Old Vehicles.

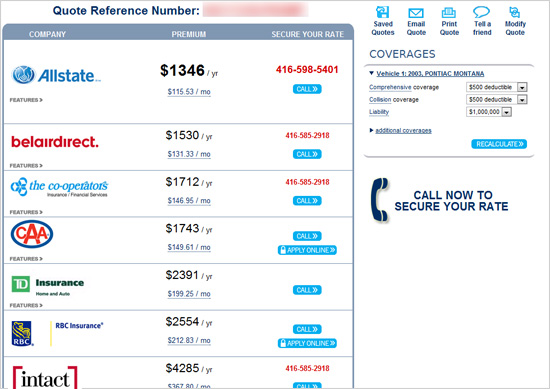

For those who have a mature vehicle — through which i imply 1 that is really worth under $2, 000 at wholesale prices (the quantity an automobile seller might provide you with should you had been buying and selling this in) cancel any kind of Thorough as well as Crash Protection you’ve or even decrease which choice whenever obtaining a auto insurance quotation.

Here is the reason why. In the event that a good 8 year-old vehicle as well as a fresh vehicle possess similar harm, the price to correct each is going to be similar too, despite the fact that the actual 8 year-old vehicle may be worth next-to-nothing.

The thing is the price of the bumper as well as fender would be the exact same — be it with regard to a fresh vehicle, or even one which is actually 8 years-old. This is exactly why your own rates do not drop since the worth from the vehicle falls. Your instalments stay nearly exactly the same, year-after-year-after-year.

However, the underside drops-out associated with exactly what you can gather upon which old vehicle. For example, in case your vehicle is actually “totaled”, your own insurance provider is only going to spend a person the actual at wholesale prices worth of the vehicle.

Therefore, let’s imagine your vehicle may be worth $1, 000, however the complete harm is actually a lot more than $4, 000, the actual insurance provider will simply provide you with a look for $1, 000…. without your own insurance deductible, obviously.

To end up receiving $500 back again. Seems like the poor offer…. however that is exactly how this functions.

Therefore, the actual rule-of-thumb is actually this particular — cancel your own compensation & crash protection whenever your automobiles worth is actually under $2, 000…. or even you will be tossing your hard earned money aside.

Alright — you have jotted lower a few information as well as will be ready to help to make a few modifications for your car insurance. Therefore get the telephone and begin reducing your own rates!

Ways to get Despite Your vehicle Insurance provider Within 10 Simple steps — Component two